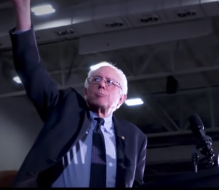

Bernie Sanders’ Student Debt Forgiveness Plan Ignores Reality, Much Like Elizabeth Warren’s Similar Plan

With the 2020 presidential campaign season underway, presidential candidates are making promises that many may not be able to keep if elected to the White House. The new and trendy campaign promise is to wipe out student loan debt in the United States, which Massachusetts Senator Elizabeth Warren proposed last month.

With two major tiers of candidates in the Democratic Party, which featured ten candidates participating in an “undercard” debate last Wednesday night and the top ten challengers on Thursday night, candidates are turning to progressive and liberal campaign promises to separate themselves from the pack.

Vermont Senator Bernie Sanders, an avowed socialist supporter, has unveiled his version of wiping out American student loan debt. His proposed bill, similar to Warren’s, relies on the federal government paying for the debt. But Sanders’ bill is different because it requires the federal government to “provide $47 billion per year to states to eliminate undergraduate tuition and fees at public colleges and universities.” In other words, it is an annual grant from the federal government, sent to the states, to pay down the student loan debt.

The federal government will have the funds to pay for student loan debt because Sanders proposes a tax on Wall Street to pay for the grants. He proposes a 0.5% tax, “a Wall Street speculation fee,” on investment houses, hedge funds and other speculating firms, a 0.1% fee on bonds, and a 0.005% fee on derivatives. Yet, Sanders does not provide a specific number of how much money these proposed taxes would raise, saying the following:

“It has been estimated that this provision could raise hundreds of billions a year which could be used not only to make tuition free at public colleges and universities in this country, it could also be used to create millions of jobs and rebuild the middle class of this country.”

Sanders’ bill, which is called the College for All Act, requires states to cover 33% of the cost of tuition while the federal government pays for 67% of tuition. In order to receive these grants from the federal government, states must satisfy “a number of requirements designed to protect students, ensure quality, and reduce ballooning costs.” Yet, Sanders did not outline what those requirements are in his initial proposal, unless he meant more spending on higher education, need-based financial aid, and reduce “reliance on low-paid adjunct faculty.”

Instead, Sanders claims these grants will be used to “increase academic opportunities for students, hire new faculty, and provide professional development opportunities for professors.” His plan restricts funding administrator salaries, merit-based financial aid, or building stadiums and student centers since they are non-academic purposes.

Other aspects of the proposed bill are as follows:

- Lowering student loan interest rates to 2006 levels (2.32% instead of 4.32%) while ensuring rates are fixed at 8.25%,

- Allow “borrowers to refinance their loans based on interest rates available to current students,”

- Expand the federal work study program and focus on “schools enrolling high numbers of low-income students,”

- Eliminate annual applications for financial aid through a pilot program while simplifying the process and remove barriers to low-income students

The College for All Act ignores the power of the free market, such as supply and demand, which drives down adjunct faculty paychecks. The proposed bill does not address the issues with tenure, which makes it difficult to fire faculty, but it does address rising administrator salaries and exorbitant costs associated with building new stadiums at colleges and universities.

Here are the main similarities between Sanders’ plan and Warren’s plan:

- The federal government, meaning the American taxpayer, will foot the bill to pay down about $70 billion in student loan debt,

- Both ignore how federal government funding is essentially a subsidy, driving tuition prices higher at colleges and universities,

- Both promise that their plans will wipe out student loan debt.

In the end, Sanders’ proposed bill promises more federal government intervention in people’s decisions in order to placate the indebted student masses, without giving much detail on how it will be accomplished.